Fill Out Your State Of New Mexico Wc 1 Form

In the evolving landscape of employment-related regulations, New Mexico's WC-1 form plays a critical role in ensuring the compliance of businesses with the Workers' Compensation Act. As of the third quarter of 2004, the legislature mandated an increase in the quarterly workers' compensation fee to $4.30 for each covered worker, impacting only the employer's financial obligation. It is imperative for employers operating within the jurisdiction of New Mexico, obliged either by statutory requirement or by voluntary participation, to meticulously complete and submit this form, alongside the requisite fee. The Form WC-1 requires employers to disclose the number of covered employees as of the last working day of the calendar quarter being reported. A foundational element of this mandate is the stipulation that if an employer finds themselves without any covered employees, a notation of zero must be entered on the form. Timeliness in submission is underscored through the designation of deadlines falling on the last day of the month subsequent to the end of a reporting period, which encompasses the quarters ending on the last day of March, June, September, and December. Moreover, the necessity for accuracy and completeness in filling out the form is paralleled by the procedural directive to remit payment to the Taxation and Revenue Department, ensuring both the employer's compliance with statutory obligations and the maintenance of workers' compensation infrastructure in New Mexico. Such measures not only underscore the state's commitment to worker protection but also delineate the responsibilities vested in employers to uphold these standards.

State Of New Mexico Wc 1 Sample

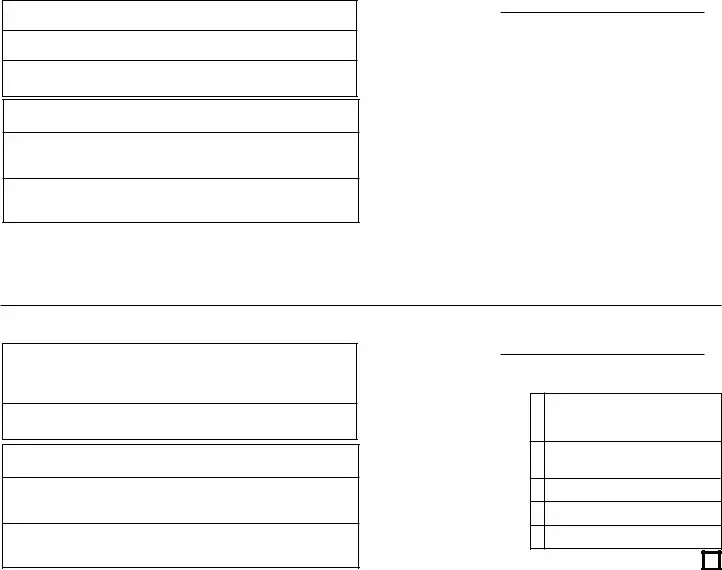

STATE OF NEW MEXICO

TAXATION AND REVENUE DEPARTMENT

Beginning with calendar quarter ending September 30, 2004, the quarterly workers' compensation fee paid on Form

See the instructions for details.

WHO MUST FILE: Every employer who is covered by the Workers' Compensation Act, whether by requirement or election, must file and pay the New Mexico Workers' Compensation Fee and file Form

*IMPORTANT: On Line 1, enter the number of workers (employees) to whom the Workers' Compensation Fee applies. This is the number of covered employees you employed on the last working day of the calendar quarter. If you have no covered employees, enter zero.

WHEN TO FILE: The Workers' Compensation Fee is due on or before the last day of the month following the close of the report period. A report period is a calendar quarter ending March 31, June 30, September 30 and December 31.

Upon completion of this form, sign, date and enter your phone number and

Mail the bottom portion of this form with payment to New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa

Fe, NM

A.FEIN:

B.CRS:

C.EAN:

NAME:

STREET/BOX:

CITY, STATE, ZIP:

REPORT PERIOD:

Beginning

1. *Number of covered |

|

|

|

|

|

||

|

workers at close of |

|

|

|

report period |

1. |

|

2. |

Assessment fee |

2. |

$ |

3. |

Penalty |

3. |

$ |

4. |

Interest |

4. |

$ |

5. |

Total due |

5. |

$ |

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

WORKERS' COMPENSATION FEE

A. |

FEIN: |

|

|

B. |

CRS: |

REPORT PERIOD:

Beginning |

Ending |

C. EAN: |

NAME: |

STREET/BOX:

CITY, STATE, ZIP:

1.*Number of covered workers at close of report period

2.Assessment fee

3.Penalty

4.Interest

5.Total due

1.

2.$

3.$

4.$

5.$

Check if amended

Signature ___________________________________ Phone ______________ Date _____________

Mail to: Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM |

WKC |

File Specifics

| Fact Name | Description |

|---|---|

| Form Number and Name | WC-1 - Workers' Compensation Fee Form |

| Rate Increase Date | Starting with the quarter ending September 30, 2004, the fee increased from $4 to $4.30 per covered employee. |

| Filing Requirement | All employers covered by the Workers' Compensation Act, whether required or by election, must file this form and pay the associated fee. |

| Due Date | The Workers' Compensation Fee is due on or before the last day of the month following the end of a calendar quarter. |

How to Use State Of New Mexico Wc 1

Filing the State of New Mexico WC-1 form is a crucial process for employers to ensure they are compliant with the state's Workers' Compensation laws. This form helps in reporting and paying the workers' compensation fee, which is a requirement for all employers covered under the New Mexico Workers' Compensation Act. The steps involved in completing the form are straightforward but must be followed carefully to avoid errors and potential penalties.

- Identify the report period for which you are filing by noting the beginning and ending dates (mm-dd-yy) of the calendar quarter.

- Enter your Federal Employer Identification Number (FEIN) in section A.

- Provide your CRS Identification Number in section B.

- If applicable, fill out the Employer Account Number (EAN) in section C.

- Write down the legal name of your business where indicated.

- Fill in your business’s mailing address, including street or P.O. box, city, state, and ZIP code.

- Determine the number of covered workers you employed on the last working day of the calendar quarter and enter this number on line 1.

- Calculate the total assessment fee, which is $4.30 per covered worker, and enter this amount on line 2.

- If applicable, include any penalties in section 3. This needs to be determined based on the specifics of your situation and in accordance to New Mexico state guidelines.

- Enter any interest that may be due in section 4, if applicable. Calculation of interest would depend on late payments and according to state regulations.

- Add up the amounts from lines 2, 3, and 4 to determine the total due, and enter this figure in section 5.

- Sign the form to certify the information provided. Include your phone number and email address for contact purposes.

- Write a check or obtain a money order for the total due amount, making it payable to Taxation and Revenue Department.

- Cut the bottom portion of the form as indicated and mail this portion along with the payment to the New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527. Retain the top portion of the form for your records.

- If any information has changed or corrections are needed, check the "amended" box before submitting the form.

After the form and the corresponding payment are mailed to the New Mexico Taxation and Revenue Department, it is important for employers to keep a copy of the form for their records. This ensures that there is proof of compliance with the Workers' Compensation Act's requirements. Timely and accurate completion of the WC-1 form helps avoid potential fines and ensures that employees are properly accounted for under New Mexico's workers' compensation program.

Understanding State Of New Mexico Wc 1

FAQs about the State of New Mexico WC-1 Form

- Who needs to file the New Mexico WC-1 Form?

Every employer who is covered by the Workers' Compensation Act in New Mexico, whether required by law or by choice, needs to file the WC-1 Form. This applies to those who have at least one employee under their employment on the last working day of the calendar quarter.

- When is the WC-1 Form due?

The WC-1 Form must be filed and the corresponding workers' compensation fee paid by the last day of the month following the close of a report period. Report periods end on March 31, June 30, September 30, and December 31 of each year.

- How much is the Workers' Compensation Fee?

Since the calendar quarter ending September 30, 2004, the workers' compensation fee has been $4.30 per covered worker. It's important to note that this amount reflects only the employer's share of the fee.

- What should I do if I have no covered employees to report for a quarter?

If you did not have any covered employees on the last working day of a calendar quarter, you should still file the WC-1 Form. Enter zero in the space provided on Line 1 to indicate that no covered employees were employed during that period.

- Where and how to submit the WC-1 Form and payment?

The completed WC-1 Form along with the payment by check or money order made payable to the Taxation and Revenue Department must be mailed to New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527. Remember to include the bottom portion of the form with your payment and retain the upper portion for your records.

For further assistance with the WC-1 Form or other questions, employers are encouraged to contact the Taxation and Revenue Department at (505) 827-0832 or review the detailed instructions provided with the form.

Common mistakes

When it comes to navigating workers' compensation, accurately completing the State Of New Mexico WC-1 form is crucial for employers. Mistakes can lead to delayed processing, penalties, or incorrect payment amounts. Here are five common errors to avoid:

Incorrect Number of Employees: On Line 1, employers must enter the total number of workers covered at the close of the reporting period. A common mistake is inaccurately counting the number of employees, either by overestimation or underestimation. It's crucial to review employee records for the correct count to ensure the correct fee is calculated.

Failure to Update Contact Information: Not updating the contact details, including the street/box address, city, state, zip, phone number, and email address, can lead to communication delays or missed correspondence about the form or fees owed. Always double-check this section before submission.

Incorrect Calculation of Fees: The assessment fee on Line 2 depends on the number of covered workers and must be calculated accurately. Often, mistakes occur in calculating the correct amount due to misunderstanding the rate per employee or the number of employees. Use the current rate and double-check your math.

Overlooking Penalties and Interest: Lines 3 and 4 are for penalties and interest that may accrue if the form is filed or fees are paid late. Ignoring these lines when applicable, or miscalculating the amounts, can result in underpayment and further penalties.

Forgetting to Sign and Date: A surprisingly common oversight is forgetting to sign and date the bottom of the form. This simple yet crucial step validates the form. Without a signature and date, the form is considered incomplete and can delay processing.

To avoid these pitfalls, take the time to thoroughly review the instructions provided with the form, double-check all figures and information provided, and ensure that the form is complete before submission. Accuracy and attention to detail when completing Form WC-1 can save time and prevent unnecessary complications with workers' compensation fees.

Documents used along the form

Navigating the paperwork required for worker's compensation in New Mexico can feel like a daunting task for any employer. But understanding the forms and documents that often accompany the State of New Mexico WC-1 form can simplify the process. Armed with the right documents, employers can ensure compliance, protect their employees, and safeguard their business.

- Employer's First Report of Injury or Illness (Form E1.2): This form must be filed by the employer when an employee gets injured or falls ill due to a work-related incident. It initiates the claim process.

- Wage Verification Form (Form WC-104): Used to verify the wages of the employee who is making a workers' compensation claim, this document helps in determining compensation amounts.

- Notice of Accident (Form NOA): Employees must use this form to report any work-related accident or illness to their employer, typically within 15 days of the incident. It's crucial for documenting the occurrence of an injury or illness.

- Annual Payroll Report (Form WC-10): Employers file this form annually to report their total payroll, which aids in the calculation of workers' compensation fees and insurance premiums.

- Certificate of Insurance: This document serves as proof that the employer has the necessary workers' compensation insurance. It's often requested by commercial clients or during state inspections.

- Notice of Benefit Payment (Form WC-8): This form is used by employers or insurers to notify the state of any compensation payments made to an employee under a workers' compensation claim.

- Employee's Claim Petition (Form WC-3): Employees use this form to formally request workers' compensation benefits. It outlines the nature of the injury or illness and the benefits being sought.

- Agreement of Final Settlement (Form WC-42): This document is used to outline the final settlement agreement between the employer, insurer, and employee regarding a workers' compensation claim.

While the list above is not exhaustive, it highlights the essential forms and documents that employers in New Mexico are likely to encounter when navigating workers' compensation claims. Each document plays a critical role in ensuring that both the employer and employee fulfill their obligations and receive their entitled benefits under the law. By staying informed and prepared, employers can navigate the complex landscape of workers' compensation with confidence.

Similar forms

The State of New Mexico WC-1 form, designated for the reporting and payment of the workers' compensation fee, shares rationale and structural elements with several other state and federal documents designed for similar regulatory and financial reporting purposes. These documents often serve as tools for compliance with specific legislation, ensuring that entities adhere to outlined financial obligations within designated timeframes.

The Federal IRS Form 941, the Employer's Quarterly Federal Tax Return, is one of such documents sharing similarities with the WC-1 form. Both forms are used to report on a quarterly basis, ensuring employers fulfill their financial responsibilities—Form 941 details federal income tax withheld from employees, social security, and Medicare taxes, while the WC-1 form focuses on workers' compensation fees. Each requires the employer’s identification information, the reporting period, and a detailed account of the fees or taxes due, broken down into specific categories such as total number or employees covered, the total amount due, and any penalties or interest served for late filings.

The UI-3/40 Form, used in several states for Unemployment Insurance reporting, also aligns closely with New Mexico’s WC-1 form in its purpose and structure. The UI-3/40 specifically collects information on the total wages paid to employees, facilitating the calculation and collection of unemployment insurance contributions by the state. Like the WC-1, it requires the employer to list their business identification details, the number of employees, and the specific reporting period. Both forms play crucial roles in maintaining the fiscal integrity of state-administered programs aimed at supporting workers.

Another similar document is The Quarterly Combined Withholding, Wage Reporting and Unemployment Insurance Return seen in New York State, labeled NYS-45. This comprehensive form blends the elements of wage reporting and tax collection into a single filing, analogous to the purpose served by the WC-1 form, albeit on a broader scale. It gathers detailed employee wage data alongside unemployment and withholding tax information, aiming to streamline the process for employers. Each form, be it the NYS-45 or the WC-1, facilitates a crucial aspect of compliance, reporting, and remittance of employer-driven financial obligations within a regulated timeframe.

Dos and Don'ts

When you're tasked with filling out the State of New Mexico WC-1 form, it's crucial to approach it with diligence and accuracy to ensure compliance with state requirements. To help you navigate this process smoothly, here's a compiled list of dos and don'ts:

Do:- Review the instructions carefully: Before you start filling out the form, make sure to read the accompanying instructions thoroughly to understand each section and what is required of you.

- Report accurate employee counts: On Line 1, you must enter the accurate number of covered workers employed on the last working day of the calendar quarter. Ensuring this number is correct is vital for calculating your workers' compensation fee properly.

- File on time: Note the due date for submission is the last day of the month following the close of the report period. Timely filing is essential to avoid penalties and interest charges.

- Double-check your calculations: Ensure the assessment fee, penalty (if applicable), interest (if applicable), and total due are all calculated correctly. Errors can lead to discrepancies and possible penalties.

- Include correct payment information: Make your check or money order payable to the Taxation and Revenue Department. Verify that the payment amount matches the total due reported on the form.

- Keep a copy for your records: After completing the form, cut the bottom portion and mail it with your payment. However, retain the top portion for your records.

- Estimate employee counts: Guessing or estimating the number of covered workers can lead to inaccuracies in your workers' compensation fee calculation. Always use actual counts.

- Miss the filing deadline: Failing to submit your form and payment by the due date can result in penalties and interest charges, adding unnecessary costs to your business.

- Omit contact information: Neglecting to include your phone number and email address on the form can lead to issues if the Taxation and Revenue Department needs to contact you for any reason.

- Make payments to the wrong entity: Ensure that payments are directed to the Taxation and Revenue Department to prevent misplacement and potential legal issues.

- Forget to sign the form: An unsigned form is considered incomplete and will likely be returned to you, causing delays in processing and potential late fees.

- Ignore errors from previous quarters: If you discover a mistake in a previously filed WC-1 form, take the appropriate steps to amend the error rather than ignoring it. Filing an amended form correctly is crucial for maintaining compliance.

Adhering to these guidelines will streamline the process of completing and submitting the State of New Mexico WC-1 form, helping to ensure that you remain in good standing with the state's Workers' Compensation Act requirements.

Misconceptions

When it comes to workers' compensation in New Mexico, especially filing the WC-1 form, there are several misconceptions that can cause confusion for employers. Understanding these can help ensure compliance and smooth out the process.

Only large businesses need to file Form WC-1: Any employer covered by the Workers' Compensation Act, regardless of the size of their workforce, needs to file this form. This includes both small and large businesses.

The fee has remained the same over the years: As of September 30, 2004, the quarterly workers' compensation fee per covered worker increased from $4 to $4.30. It's important for employers to stay updated on rate changes to avoid underpayment.

Filing is required only when there are claims: Every covered employer must file Form WC-1 and pay the workers' compensation fee quarterly, regardless of whether any claims were made or not during that period.

The form is complicated to file: While any official form can seem daunting at first, the WC-1 form instructions are clear about what information is needed. Employers just need to provide details like the number of covered employees and the total due for the quarter.

Personal checks are not an acceptable form of payment: Payments can be made via check or money order payable to the Taxation and Revenue Department, contradicting any belief that personal checks are not allowed.

Penalties and interest apply only for late filing: While late filing can indeed incur penalties and interest, inaccuracies in reporting, such as underreporting the number of covered workers, can also result in additional fees.

Electronic filing isn't available: While the instructions do not explicitly mention e-filing, employers should check the latest updates from the New Mexico Taxation and Revenue Department as electronic options might be available, improving the ease of filing.

Clearing up these misconceptions can help employers navigate the requirements more effectively, ensuring that they remain in good standing and avoid unnecessary penalties. It's always a good practice to consult with the Taxation and Revenue Department or a professional when in doubt.

Key takeaways

Filling out and submitting the State of New Mexico WC-1 form is a critical task for employers covered by the Workers' Compensation Act. To ensure compliance and avoid unnecessary penalties, here are four key takeaways about the form and its requirements:

- Know who must file: The WC-1 form is mandatory for every employer who falls under the Workers' Compensation Act, regardless of whether coverage is required by law or elected by the employer. This broad requirement underscores the importance of understanding your obligations under the Act.

- Accurately report covered employees: It's crucial to correctly report the number of employees covered at the close of the report period on line 1. Errors can lead to miscalculated fees and potential penalties. Whether you have no covered employees or hundreds, accurate reporting helps maintain compliance.

- Adhere to deadlines: Timeliness is key. The workers' compensation fee is due on or before the last day of the month following the close of each calendar quarter. Missing these deadlines can result in penalties and interest charges, making it vital to have a systematic approach to filing.

- Keep records and make checks payable correctly: After filling out the form, part of it along with the payment needs to be mailed to the specified address. Keeping the top portion for your records is a recommended practice for any future reference or audits. Moreover, ensuring that payments are made to the Taxation and Revenue Department minimizes the risk of misdirected funds.

Understanding these key aspects of the WC-1 form can significantly help employers in New Mexico stay compliant with workers' compensation reporting requirements. Being aware and proactive in managing these responsibilities protects both the employer and its employees.

Other PDF Forms

New Mexico Franchise Tax - Essential for owners, including partners, members, and beneficiaries, to correctly file their state income taxes.

Nm Courts Forms - Amplifies the plaintiff's voice by formally presenting their case to the legal system, seeking redress for alleged wrongs.

Nm Board of Nursing - The provision for supervisor verification of employment details ensures an additional layer of validation for information provided by the applicant.