Fill Out Your Cit 1 New Mexico Form

In today's globally integrated business landscape, companies operating within the United States, including those in New Mexico, must navigate a complex framework of taxation regulations that are always evolving. The 2020 CIT-1 New Mexico Corporate Income and Franchise Tax Return is a critical document for corporations operating within this jurisdiction, mandating thorough compliance and accuracy in reporting corporate income and franchise tax liabilities. This detailed form not only solicits basic corporate information such as the corporation's name, mailing address, and Federal Employer Identification Number (FEIN) but also dives deeper into specifics about the business's incorporation date, principal business activities, and accounting methods. It examines the corporation's fiscal year, prompting for modifications if the federal income tax liability has changed due to audits or amended federal returns and questions about unitary group filings, which could significantly impact tax calculations. Furthermore, the form adapts to various corporate scenarios, including final returns for dissolved, merged, or withdrawn businesses, while also providing options for direct deposit of refunds, ensuring a streamlined process for return submissions. The intricacies of this form underscore the importance of meticulous record-keeping and an updated understanding of tax obligations, reinforcing the necessity for corporations in New Mexico to carefully complete and submit the CIT-1 form to maintain compliance with state tax laws.

Cit 1 New Mexico Sample

2022

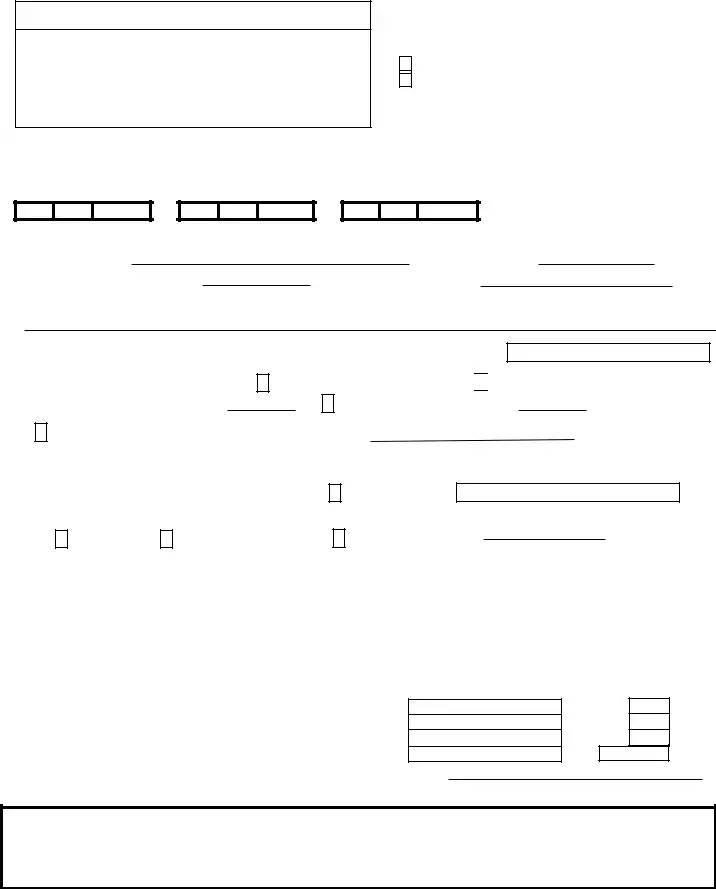

NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN

Corporation name

1a

Mailing address (number and street name)

2a |

|

|

|

|

|

City |

|

State |

Postal/ZIP code |

3a |

|

|

|

|

|

|

|

|

|

|

If foreign address, enter country |

Foreign province and/or state |

||

3b |

|

|

|

|

|

|

|

|

|

|

FEIN (Required) |

New Mexico Business ID # |

||

5a |

|

5b |

|

|

|

*226080200* |

|||||||

CHECK ONE (Required): |

|

|

|

|

|

|||

4a |

Original Return |

|

|

FOR DEPARTMENT USE ONLY |

||||

|

|

|

|

|

||||

4b |

Amended Return |

|

|

|

|

|

||

|

4b.(i) Type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4b.(ii) Date: |

|

|

|

|

|

|

|

|

|

|

|

6d |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact phone number |

|||

Fiscal (or |

Extended Due Date |

6a

6b

6c

COMPLETE THE FOLLOWING: |

|

|

A. |

State of incorporation |

A1. Date of incorporation |

B. |

Date business began in New Mexico |

B1. State of commercial domicile |

C. |

Name and address of registered agent in New Mexico |

|

|

|

First Name and Last Name |

|

Address |

|

|

||||

|

|

|

|

|

|

|

|

D. |

NAICS Code (Required) |

|

|

|

|||

E. |

Is this a return for a unitary group? Yes |

|

No |

||||

|

|||||||

|

|

|

|

|

|||

|

|

|

|

|

|||

City |

State |

ZIP code |

D1. Principal business activity in New Mexico

E1. If yes, which type of unitary group?

worldwide combined group

worldwide combined group

consolidated group. Year of election

Member of a unitary group, filing separately. Name of parent entity

NOTE: A unitary group has certain filing requirements. See page 9 of the instructions for definition.

F. Indicate method of accounting: |

|

Cash |

|

Accrual |

|

|

|

|

|

G.If this is the corporation's final return, was the corporation:

Other (specify) F1.

Dissolved

Merged or reorganized

Withdrawn |

G1. Date |

H.Has this corporation's federal income tax liability changed for any year due to an IRS audit or the filing of an amended federal return that has not

been reported to New Mexico? Yes |

|

No |

|

If yes, submit an amended New Mexico Corporate Income and Franchise Tax Return, |

and a copy of the amended federal return or Revenue Agent's Report (RAR), if applicable, to the New Mexico Taxation and Revenue Department.

I. If this a return for a filing group, complete the following information for each corporation in the filing group.

The total of column 3 must equal

|

|

|

Column 3 |

Column 4 |

Column 1 |

|

Column 2 |

Amount of quarterly, tentative, or other |

$50 if corporation |

Corporation name |

|

FEIN |

payments to apply to this return |

pays franchise tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals

J.If other than a corporation, enter your legal entity type (for example, LLC or partnership):

Refund Express!!

RE1 1. Routing number:

RE2 2. Account number:

Have your refund directly deposited. See instructions and fill in 1, 2, 3, and 4.

|

RE3 3. Type: Checking |

|

Savings |

|

|

|

|

Enter X. |

|

Enter X. |

|

|

|

|

|

||

|

|

|

|

|

|

4.REQUIRED: WILL THIS REFUND GO TO OR THROUGH AN ACCOUNT LOCATED OUTSIDE THE UNITED STATES? If yes, you may not use this refund delivery option. See instructions.

RE4 YES |

|

|

|

You must answer |

|

NO |

|

this question. |

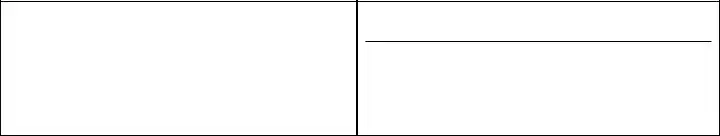

2022

NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN

|

FEIN |

*226090200* |

|||||

|

|

|

|||||

|

|

|

|||||

1. |

Taxable income before NOL and special deductions (see |

|

|

||||

1. |

|

||||||

|

|

|

|

|

|

|

|

|

1a. Captive REIT deductions. |

|

1a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

1b. Exempt entity deductions. |

|

1b. |

|

|

|

|

2. |

|

|

|

|

|

||

Interest income from municipal bonds, excluding New Mexico bonds. |

2. |

|

|||||

3. |

Other additions to the base income of a unitary group (see |

3. |

|

||||

4. |

Subtotal of base income after additions. Add lines 1, 1a, 1b, 2 and 3. |

4. |

|

||||

5. |

Federal special deductions (from federal Form 1120, line 29b). Enter only a positive number. |

5. |

|

||||

6. |

Interest from U.S. government obligations or |

6. |

|

||||

7. |

Certain foreign dividends, Subpart F income, and GILTI (from |

|

|

||||

7. |

|

||||||

8. |

Other subtractions to the base income of a unitary group (see |

|

|

||||

8. |

|

||||||

9. |

New Mexico net income or loss. Subtract lines 5, 6, 7, and 8 from 4. |

9. |

|

||||

10. |

Net allocated income or loss (from |

|

|

|

10. |

|

|

11. |

Total apportionable income or loss. Subtract line 10 from line 9. |

11. |

|

||||

12. |

New Mexico apportionment percentage (from |

12. |

_ _ _ . _ _ _ _ % |

||||

13. |

Income or loss apportioned to New Mexico. Line 11 multiplied by the percentage on line 12. |

13. |

|

||||

14. |

Net New Mexico allocated income or loss (from |

14. |

|

||||

15. |

New Mexico apportioned net income or loss. Add lines 13 and 14. |

15. |

|

||||

16. |

Net operating loss deduction, not in excess of 80% of line 15. Attach form |

16. |

|

||||

17. |

Liquor license lessor deduction. See |

17. |

|

||||

18. |

Exemption for net income subject to the Entity Level Tax. See |

|

|

||||

18. |

|

||||||

19. |

New Mexico taxable income. Subtract line 16, 17, and 18 from 15. |

|

|

||||

19. |

|

||||||

20. |

New Mexico Income tax. Tax on amount on line 19 (see tax table on page 13 of |

20. |

|

||||

21. |

Total tax credits applied against the income tax liability on line 20 (from |

21. |

|

||||

22. |

Net income tax. Subtract line 21 from line 20. Amount cannot be negative. |

22. |

|

||||

23. |

Franchise tax ($50 per corporation). |

|

|

|

23. |

|

|

24. |

Total income and franchise tax. Add lines 22 and 23 |

24. |

|

||||

25. |

Amended Returns Only. Enter amount of all 2022 refunds received and overpayments applied to 2023. Also |

25. |

|

||||

|

see instructions for line 27 |

|

|

|

|

|

|

|

|

|

|

|

|

||

26. |

Subtotal. Add lines 24 and 25. |

|

|

|

|

|

|

|

|

|

26. |

|

|||

27. |

Total Payments: q Quarterly q Extension |

qApplied from prior year |

27. |

|

|||

|

27a. q Mark this box if you want to use method 4 to calculate penalty and interest on underpayment of |

|

|

||||

|

estimated tax. See instructions, attach |

|

|

||||

28. |

|

|

|

|

|

||

New Mexico income tax withheld from oil and gas proceeds. Attach Forms |

28. |

|

|||||

29. |

New Mexico income tax withheld from a |

29. |

|

||||

30. |

Total payments and tax withheld. Add lines 27 through 29. |

30. |

|

||||

31. |

Tax due. If line 26 is greater than line 30, subtract line 30 from line 26. |

31. |

|

||||

32. |

|

|

|

|

|

|

|

Penalty. See |

|

|

|

32. |

|

||

33. |

Interest. See |

|

|

|

33. |

|

|

34. |

|

|

|

|

|

||

Total amount due. Mail your check separately with |

34. |

|

|||||

35. |

Overpayment. If line 30 is greater than line 26, enter the difference. |

35. |

|

||||

36. |

Amount of overpayment to apply to 2023 liability (not more than line 35). |

36. |

|

||||

37. |

Amount of overpayment to refund. Subtract line 36 from line 35. |

37. |

|

||||

38. |

Total portion of tax credits to refund (from |

|

|

||||

38. |

|

||||||

39. |

Total refund of overpaid tax and refundable credit due to you. Add lines 37 and 38. |

39. |

|

||||

Taxpayer's Signature

I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

Signature of officer |

Date |

|

|

|

|

|

|

|

Title |

Contact phone number |

|

Taxpayer's email address |

|

|

|

Paid Preparer's Use Only

Signature of preparer if |

other than employee of the taxpayer |

Date |

|

P1 |

NMBTIN ____________________________ |

|

|

P2 |

FEIN |

_ |

|

P3 |

Preparer's PTIN |

_____________________ |

|

P4 |

Preparer's phone number ____________________________ |

||

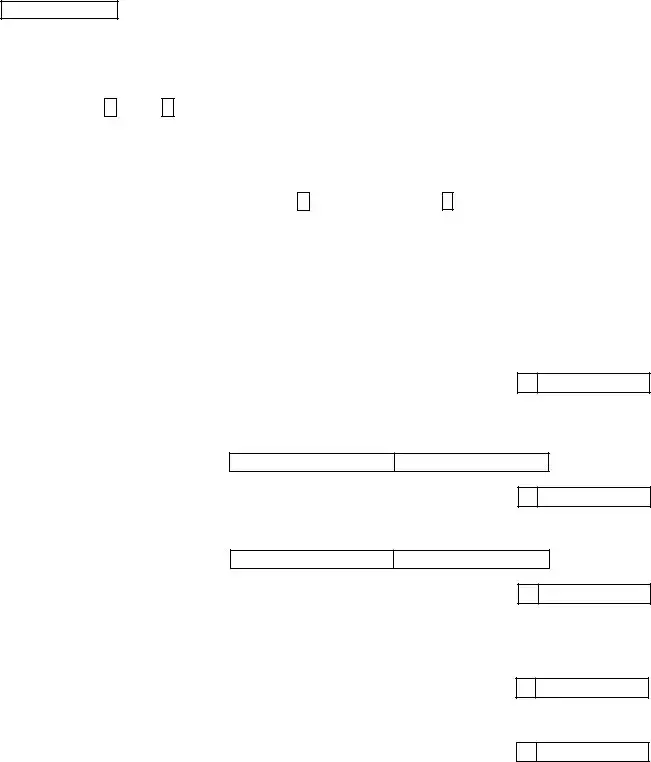

2022

NEW MEXICO APPORTIONED INCOME FOR |

*226280200* |

MULTISTATE CORPORATIONS (attach to |

|

|

FEIN

Taxpayers with income from inside and outside New Mexico must complete this schedule.

The Department cannot accept computerized schedules instead of this form. You must complete column 1, Total Everywhere, and all other applicable line items for the Department to process the return. Round all dollar amounts.

A. Have you changed your reporting of any class or type of allocated or apportioned income from the way it was reported in

a prior taxable year?

Yes

No

B. This entity submitted written notification of its election to use one of the special methods of apportionment of business

income for tax year ending _______________. The effective date of the election is |

______________. See instructions. |

Month/Day/Year |

Month/Day/Year |

C. Mark the box indicating the special method elected.

Manufacturers

Headquarters Operation

PROPERTY FACTOR

Average annual value of inventory |

1a |

Average annual value of real property |

1b |

Average annual value of personal property |

1c |

Rented property. Multiply annual rental value by 8 |

1d |

Total property |

1e |

Column 1 |

Column 2 |

Percent |

Total Everywhere |

Inside New Mexico |

Inside New Mexico |

|

|

Calculate each |

|

|

|

|

|

percentage to four |

|

|

|

|

|

decimal places; for |

|

|

|

|

|

example, 22.5431%. |

|

|

|

1. Property factor. Divide Total property column 2 by column 1 and then multiply by 100...............................................

PAYROLL FACTOR

1

_ _ _ . _ _ _ _%

Wages, salaries, commissions, and other compensation |

2a |

|

of employees related to apportionable income |

|

|

|

|

|

2. Payroll factor. Divide column 2 by column 1 and then multiply by 100 |

+ |

|

SALES FACTOR

2

_ _ _ . _ _ _ _%

gross receipts |

3a |

3. Sales factor. Divide column 2 by column 1 and then multiply by 100 |

+ |

3

_ _ _ . _ _ _ _%

4. |

Sum of factor percentages. Add lines 1, 2, and 3 |

+ |

||

|

4a. Count of factors. Enter the total count of all factors used |

|

|

|

|

4a |

|

|

|

|

NEW MEXICO PERCENTAGE. Divide line 4 by the count of factors used to calculate line 4a |

|

|

|

5. |

||||

4_ _ _ . _ _ _ _%

5_ _ _ . _ _ _ _%

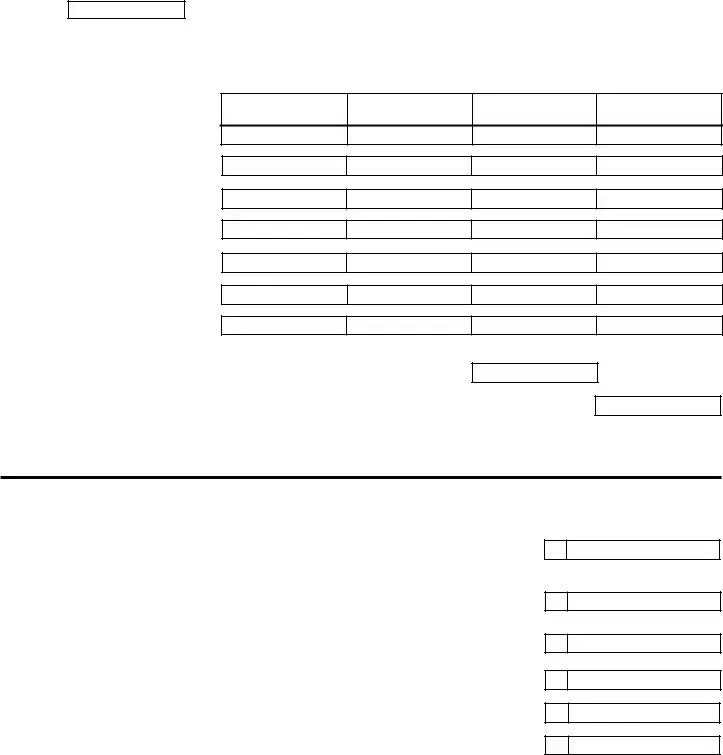

FEIN |

*226380200* |

2022

NEW MEXICO ALLOCATION OF

SCHEDULE OF INCOME NOT DERIVED FROM THE CORPORATION'S TRADE OR BUSINESS The Department cannot accept computerized schedules instead of this form. Round all dollar amounts.

1. |

1 |

|

2. |

2 |

|

3. |

3 |

|

4. |

4 |

|

5. |

Profit or loss on sale or exchange of |

|

|

5 |

|

6. |

6 |

|

7. Other |

7 |

|

|

(Attach schedule) |

|

Column 1

Gross Amount

Column 2

Related Expenses

Column 3

Column 1 less Column 2

Column 4

Allocation to New Mexico

8. |

Net allocated income. |

|

|

Enter here and on |

8 |

9. |

Net New Mexico allocated income. |

|

|

Enter here and on |

9 |

2022

CERTAIN FOREIGN DIVIDENDS, SUBPART F, AND GILTI

1.Certain dividends from foreign corporations (from federal form 1120, Schedule C, Line 14)..............................

2.Subpart F inclusions derived from hybrid dividends of tiered corporations (from federal form 1120, Schedule C,

Line 16b)..............................................................................................................................................................

3.Other inclusions from CFCs under subpart F (from federal form 1120, Schedule C, Line 16c)...........................

4.Global Intangible Low Taxed Income (GILTI) net of the deduction provided under IRC Sec. 250 (federal form 1120, Schedule C, Line 17, net of line 22)............................................................................................................

5.Foreign dividend

6.Total. Add lines 1 through 5. Also enter on line 7,

1

2

3

4

5

6

File Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The CIT-1 form is utilized for filing corporate income and franchise taxes in New Mexico. |

| Amendment Options | Corporations can file an amended return due to reasons like RAR adjustments, capital losses, or other amendments. |

| Unitary Group Filing | Specifies if the return is for a unitary group and the type, such as a worldwide combined group or a consolidated group. |

| Accounting Method Declaration | Indicates the accounting method used by the corporation, either cash, accrual, or another specified method. |

| Final Return Indications | Identifies if the corporation is filing its final return due to dissolution, merger, or withdrawal. |

| Audit Adjustments | Requires disclosure if the corporation's federal income tax liability has changed due to an IRS audit or amended federal return not yet reported to New Mexico. |

| Direct Deposit for Refunds | Provides options for refunds to be directly deposited, including necessary banking information and restrictions on international accounts. |

How to Use Cit 1 New Mexico

Filling out the CIT-1 New Mexico Corporate Income and Franchise Tax Return can seem daunting, but it's a straightforward process once you break it down step by step. This document is required for corporations operating within New Mexico to report their income and franchise tax. Ensuring that you accurately complete this form is crucial for staying in compliance with state tax obligations. Below are the steps to guide you through each part of the CIT-1 form, making the process as smooth as possible.

- Start with the basics: Fill in the corporation name, mailing address, city, state, postal/ZIP code. If the address is foreign, include the country, foreign province, and/or state.

- Enter the Federal Employer Identification Number (FEIN) and the New Mexico Business ID #.

- Specify the type of return being filed by checking the appropriate box: Original Return, Amended—RAR, Amended—Capital Loss, or Amended—Other.

- Include the contact phone number and fiscal or short-year tax period dates.

- Fill out the A to E sections with details about the corporation's state of incorporation, date of incorporation, date business began in New Mexico, name and address of the registered agent in New Mexico, and the NAICS Code. Also, note whether this is a return for a unitary group, and if yes, specify the type.

- Select the method of accounting (Cash, Accrual, or Other) and if this is the corporation's final return due to dissolution, merger/reorganization, or withdrawal.

- If the corporation's federal income tax liability has changed due to an IRS audit or filing of an amended federal return not yet reported to New Mexico, check "Yes" and provide the required amendments and documents.

- For a filing group, complete the section with each corporation’s name, FEIN, quarterly payments, and amount to apply to this return. Use CIT-S for more than three members.

- Indicate the legal entity type if other than a corporation.

- For direct refund deposit, provide the routing number, account number, type of account (checking or savings), and indicate whether the refund will go through an account outside the United States.

- Enter the pertinent financial information on page 2, including taxable income, deductions, net income or loss, and the New Mexico apportionment percentage.

- List all applicable payments, credits, and taxes due, and calculate the total amount payable or refundable.

- Sign the return, including the date, title, and contact details. If a paid preparer is used, ensure the preparer's information is included.

After completing these steps, review the form to ensure all information is accurate and complete. Once satisfied with the accuracy of the information, submit the form to the New Mexico Taxation and Revenue Department by the due date to avoid any penalties or interest. Remember, even if using a paid preparer, the responsibility for the accuracy of the return falls on the corporation. Therefore, it's crucial to choose a preparer wisely and to thoroughly review the form before submission.

Understanding Cit 1 New Mexico

Frequently Asked Questions about the CIT-1 New Mexico Form

- What is the CIT-1 New Mexico form used for?

The CIT-1 New Mexico form is used by corporations to file their annual Corporate Income and Franchise Tax Return in the state of New Mexico. It covers various sections including income, deductions, tax calculation, and credits. Moreover, it captures the entity's basic information, tax status, and details of income and franchise taxes due or refunds owed.

- Who needs to file the CIT-1 New Mexico form?

Any corporation operating within New Mexico, including those based out of state but doing business in New Mexico, must file the CIT-1 form. This requirement applies regardless of the size or income of the corporation. It's essential for entities that have generated income, incurred losses, or existed as registered entities during the tax year.

- How do I know if I need to file as a unitary group?

If your corporation is part of a group of related entities that operate under unified control and engage in integrated business activities, it may qualify as a unitary group. Entities should evaluate their operations, management structure, and financial interdependencies to determine if they meet the criteria outlined by New Mexico tax regulations. If so, selecting the appropriate unitary group filing status on the CIT-1 form is crucial, and further instructions for unitary group filing can be found in the form's guidelines.

- Can I file an amended CIT-1 form if I discover errors after submitting my original return?

Yes, corporations can file an amended CIT-1 form in case any information previously submitted needs correction or updating due to errors, overlooked deductions, or changes in tax liability. The form includes specific sections for different types of amendments, including adjustments following an IRS audit, capital loss amendments, and others. It's important to accurately complete the relevant sections and provide any necessary documentation when filing an amendment.

- What are the key deadlines for filing the CIT-1 form?

The CIT-1 form must be filed by the 15th day of the fourth month following the close of the corporation’s fiscal year. For corporations operating on a traditional calendar year, this deadline is April 15th of the following year. If an extension is needed, corporations should file for an extension by the original due date to avoid penalties. Keep in mind that extensions for filing do not extend the deadline for any tax payments due.

Common mistakes

Filling out the CIT-1 New Mexico Corporate Income and Franchise Tax Return form accurately is crucial for corporations to comply with state tax obligations and avoid penalties or additional scrutiny from the New Mexico Taxation and Revenue Department. However, mistakes can happen. Here are six common errors that need attention:

- Not providing complete identification information, such as the Federal Employer Identification Number (FEIN) or the New Mexico Business ID. These identifiers are crucial for the tax authorities to process your return correctly.

- Choosing the wrong tax year dates for the fiscal or short-year tax period. It is important to accurately state the period for which you're filing to avoid processing delays or inaccuracies in your tax liability.

- Incorrectly reporting the principal business activity or the North American Industry Classification System (NAICS) code. This code helps categorize the corporation's primary business operation and is vital for statistical and administrative purposes.

- Failing to indicate the correct method of accounting (cash, accrual, or other). This affects how income and expenses are reported and can significantly impact the tax calculation.

- Omitting details about changes in the corporation's federal income tax liability due to an IRS audit or the submission of an amended federal return. If there's been a change, an amended New Mexico return must also be submitted with the appropriate documentation.

- Miscalculating New Mexico taxable income and tax due. Errors in math can lead to either overpaying or underpaying tax, both of which have implications for the business.

By paying careful attention to these areas, corporations can improve the accuracy of their filings and minimize the risk of complications with their New Mexico Corporate Income and Franchise Tax Returns.

Documents used along the form

When filing the CIT-1 New Mexico Corporate Income and Franchise Tax Return, businesses may need to include additional forms and documents to comply fully with state tax regulations. These supplementary materials support or provide additional detail to the information captured in the CIT-1 form, ensuring that corporations accurately report their income, deductions, and tax calculations to the State of New Mexico.

- Federal Form 1120: This is the U.S. Corporation Income Tax Return form. It provides detailed information on the federal tax obligations of the corporation, which is necessary for completing the CIT-1 form, especially concerning taxable income before net operating losses (NOL) and special deductions.

- RPD-41379: Net Operating Loss Schedule. For corporations that have a net operating loss that they wish to carry forward or apply to the current tax year, this form is necessary to calculate and substantiate the loss deduction on the CIT-1.

- CIT-A: Apportionment of Income Schedule. Multistate corporations use this form to calculate the portion of income derived from New Mexico sources, which is essential for accurately completing the CIT-1.

- CIT-B: Allocation of Non-Business Income or Loss. This form helps distinguish the non-business income or loss from the total business income, which impacts the calculations on the CIT-1 form.

- CIT-C: Certain Foreign Dividends, Subpart F, and GILTI. This form deals with specific types of foreign income and must be filed in conjunction with the CIT-1 to accurately report and calculate tax on foreign dividends, Subpart F income, and GILTI outlined on the federal return.

- CIT-CR: Corporate Income Tax Credits. Corporations that qualify for income tax credits in New Mexico utilize this form to calculate and apply those credits on their CIT-1, reducing their overall tax liability.

Understanding and properly completing these additional forms ensures accurate reporting and compliance with New Mexico’s tax laws. It helps corporations take advantage of applicable deductions and credits, accurately compute their income tax liability, and avoid potential issues with state tax authorities.

Similar forms

The CIT-1 New Mexico form is similar to the federal Form 1120, which is the U.S. Corporation Income Tax Return. Both forms are designed for corporations to report their income, gains, losses, deductions, and to calculate their applicable tax liability. Like the CIT-1 form, the Form 1120 includes sections for reporting income, deductions, and credits, and requires details about the corporation's officer and financial status. Additionally, both forms have schedules attached that allow for the detailed breakout of income sources, tax computation, and credits. However, the CIT-1 form is specific to New Mexico, incorporating state tax laws and regulations which affect the calculation of taxes due to the state, whereas Form 1120 is concerned with federal tax obligations.

Another document similar to the CIT-1 New Mexico form is the CIT-A, which is the Apportionment Schedule for Multistate Corporations attached to the New Mexico Corporate Income and Franchise Tax Return. This schedule is specifically designed for corporations that operate in multiple states, including New Mexico. It helps them determine the portion of their income subject to New Mexico's corporate income tax based on the business activity conducted within the state. The process involves apportioning income using the property, payroll, and sales factors - a common approach in many states to fairly tax corporations based on where their business activities are conducted. Therefore, while the CIT-1 provides the broader framework for tax computation, the CIT-A delves into the specifics of income apportionment for multistate entities.

Finally, the CIT-C New Mexico form, detailing Certain Foreign Dividends, Subpart F, and GILTI, shares similarities with the CIT-1 form in terms of its focus on specialized income types but is specifically designed for reporting foreign income components affecting corporate tax obligations in New Mexico. It captures details about dividends from foreign corporations, Subpart F income inclusions, and Global Intangible Low-Taxed Income (GILTI) - elements that are increasingly relevant in our globalized economy. While the CIT-1 encompasses the holistic tax picture of a corporation within New Mexico, the CIT-C zone in on the specifics of foreign income nuances, harmonizing with broader tax return elements to ensure thorough tax compliance and reporting.

Dos and Don'ts

When filling out the CIT-1 New Mexico Corporate Income and Franchise Tax Return, it's essential to approach the task with precision and attention. To ensure you complete the form correctly, here are five key things you should do:

- Read the instructions thoroughly before you start. The CIT-1 form comes with detailed instructions that are designed to guide you through each section of the form. Understanding these instructions can prevent errors and ensure accurate reporting.

- Ensure all information is accurate and current. Double-check the corporation's name, mailing address, FEIN (Federal Employer Identification Number), and New Mexico Business ID to prevent processing delays.

- Use the correct method of accounting that your business follows, whether it's cash, accrual, or another method. This decision affects how you report income and expenses.

- If your corporation's federal income tax liability has changed due to an IRS audit or the filing of an amended federal return, make sure to submit an amended New Mexico return along with the required documents.

- For the direct deposit option, correctly fill in the routing and account numbers for a quicker refund. However, ensure that the account is not located outside the United For States, as this will make you ineligible for direct deposit.

Conversely, here are five things you shouldn't do:

- Avoid rushing through the form, which can lead to oversights and inaccuracies. Take your time to complete each section carefully.

- Do not leave mandatory fields blank. Missing information can lead to delays in processing your return or even result in it being sent back to you.

- Steer clear of estimating figures. Use actual financial records to report income, deductions, and credits. Estimates can result in discrepancies that complicate your tax situation.

- Avoid using a return that's intended for a different tax year. Tax laws and form requirements can change, so always use the appropriate version of the CIT-1 form for the tax year you are reporting.

- Do not ignore the signature section at the end of the form. An unsigned return is considered incomplete and will not be processed until it is properly signed by an authorized individual.

By following these guidelines, you can ensure that your CIT-1 New Mexico form is filled out correctly and efficiently, minimizing the chances of errors and delays in processing.

Misconceptions

Understanding the intricacies of the CIT-1 New Mexico Corporate Income and Franchise Tax Return can be challenging, given the complexity of tax laws and regulations. Even more challenging are the misconceptions that often surround the preparation and submission of this document. To clarify, here are seven common misconceptions about the CIT-1 form and explanations to dispel these myths.

Only physical presence establishes tax liability in New Mexico. Many believe that a corporation must have a physical presence in New Mexico to be liable for taxes. However, economic nexus rules can also establish tax obligations based solely on the level of business activity within the state.

All corporations pay the same franchise tax. While the CIT-1 form does include a standard franchise tax fee of $50 per corporation, it's important to understand the context. This amount applies universally to entities filing this form, regardless of their size or income levels, but not every entity that does business in New Mexico is subject to this franchise tax.

The CIT-1 is only for corporations. Despite its title, the CIT-1 form can be relevant for different types of legal entities beyond traditional corporations. Depending on their structure and operations, LLCs or partnerships might also need to file this form, or a related variant, to comply with New Mexico's tax laws.

Amendments are only for correcting mistakes. Amendments to the CIT-1 can indeed correct errors, but they are also used for other adjustments, such as capital loss or following an IRS audit, as outlined in sections 4b-4d. These amendments can affect a corporation’s tax liability in multiple ways, not just mistake correction.

Dissolution automatically negates future tax liabilities. Marking the corporation as dissolved (section F1) indeed informs the New Mexico Taxation and Revenue Department of a change in status. However, it does not absolve the entity of past due taxes or negate the filing of final tax returns.

The NAICS code is optional. Section D of the form requires the corporation's North American Industry Classification System (NAICS) code. This code is crucial for tax administration purposes, providing needed clarity regarding the principal business activity within New Mexico.

Income from outside New Mexico is not taxed. While the CIT-1 form calculates taxes based on income apportioned to New Mexico, certain income from outside the state may still impact the overall tax calculation. This includes considerations for unitary business groups and specific rules for apportioning income among states.

Clarifying these misconceptions is essential for ensuring compliance and optimizing tax strategy within New Mexico. It’s not just about following rules but understanding how these rules apply to each corporation's unique situation, ensuring both compliance and fiscal efficiency.

Key takeaways

Filling out the CIT-1 New Mexico form, a Corporate Income and Franchise Tax Return, requires attention to detail and an understanding of its various components. Here are key takeaways to ensure accuracy and compliance:

- Know your dates: It's crucial to accurately report the fiscal tax year's start and end dates, as well as the extended due date, if applicable. This ensures that your filing period is correctly identified.

- Identification numbers are essential: The Federal Employer Identification Number (FEIN) and the New Mexico Business ID are mandatory fields that identify your corporation for tax purposes.

- Amendment markers: Clearly indicate if you're filing an amended return by marking the appropriate box, whether due to capital loss, RAR (Revenue Agent's Report), or other reasons. This helps the tax authority process your return more efficiently.

- Corporate details matter: Accurately providing the state of incorporation, date of incorporation, and the date business began in New Mexico is crucial for tax assessments and liability determinations.

- NAICS Code: The North American Industry Classification System (NAICS) code is required and helps categorize your primary business activity, affecting taxation areas.

- Unitary group considerations: If filing for a unitary group, specify the group type and recognize that specific filing requirements may apply, influencing how income and deductions are reported.

- Accounting method: Indicate your method of accounting (cash, accrual, or other), as this impacts how you report income and expenses.

- Final returns: For final returns, provide details on the corporation's dissolution, merger, reorganization, or withdrawal, including dates, which are critical for concluding your tax obligations.

- IRS audit adjustments: If your federal income tax liability has changed due to an IRS audit or an amended federal return, you must submit an amended New Mexico return along with the federal adjustments, ensuring your state tax obligations are up-to-date.

- Refund processing: Opting for direct deposit for refunds requires careful entry of banking details and acknowledgment of restrictions regarding foreign accounts to facilitate smooth processing.

- Payments and withholdings: Accurately report your total payments, including quarterly, tentative, and other payments, to apply against your return, as well as any New Mexico income tax withheld from oil and gas proceeds or pass-through entities, ensuring your total tax liability or refund is correctly calculated.

Understanding these key points helps navigate the complexities of the CIT-1 form, ensuring compliance while potentially optimizing your tax liabilities and refunds. Each section of the form plays a crucial role in the overall tax calculation and reflects the unique aspects of your corporation's financial and operational status within New Mexico.

Other PDF Forms

Do You Have to Claim Dependents on W4 - A practical overview for employers on the implications of using Federal Form W-4 for New Mexico withholdings, ensuring employee tax obligations are met.

Refund Money Application - Streamlines the recovery of funds for individuals who have made redundant driver-related payments to the New Mexico MVD.